Why to invest in music royalties

Music royalties have recently emerged as a new asset class for investors looking for non-correlated investments with the potential for long-term returns. Investing in music royalties allows individuals to earn passive income from the royalties generated by songs, albums, and catalogs. Moreover, royalties can also increase in value over time as a result of increased demand and popularity, making them an attractive investment for both retail and savvy investors.

Non-correlated asset

One of the primary benefits of investing in music royalties is that it is a non-correlated asset. This means that music royalties do not fluctuate in value based on the performance of traditional financial markets, such as stocks, bonds, or real estate. As a result, music royalties provide investors with a hedge against market volatility and a way to diversify their investment portfolios. Another significant benefit of investing in music royalties is the potential for passive income generation. When an investor purchases a music royalty, they are essentially buying the right to collect future royalties from that song or album. This means that investors can receive a steady stream of income for years to come without having to actively manage the investment. Moreover, investing in music royalties also presents the potential for capital gains. As the popularity of a song or album grows, so does the demand for the music royalties associated with it. As a result, the value of the royalties can increase, providing investors with an opportunity to sell their investment for a profit.

A socially responsible investment

Investing in music royalties is not only a financially rewarding investment opportunity but is also a socially responsible investment. Investing in royalties provides support for artists, who may struggle to make a living from their music in the current streaming era. By investing in music royalties, investors can contribute to the growth and development of the music industry, while also generating returns.

Creating diversified portfolios of music royalties is another potential benefit. By investing in a range of songs, albums, and catalogs, investors can reduce the risk of their investment by spreading it across multiple assets. This way, if a particular song or album does not perform well, it will not significantly affect the overall return of the portfolio.

Creating a portfolio of diversified assets.

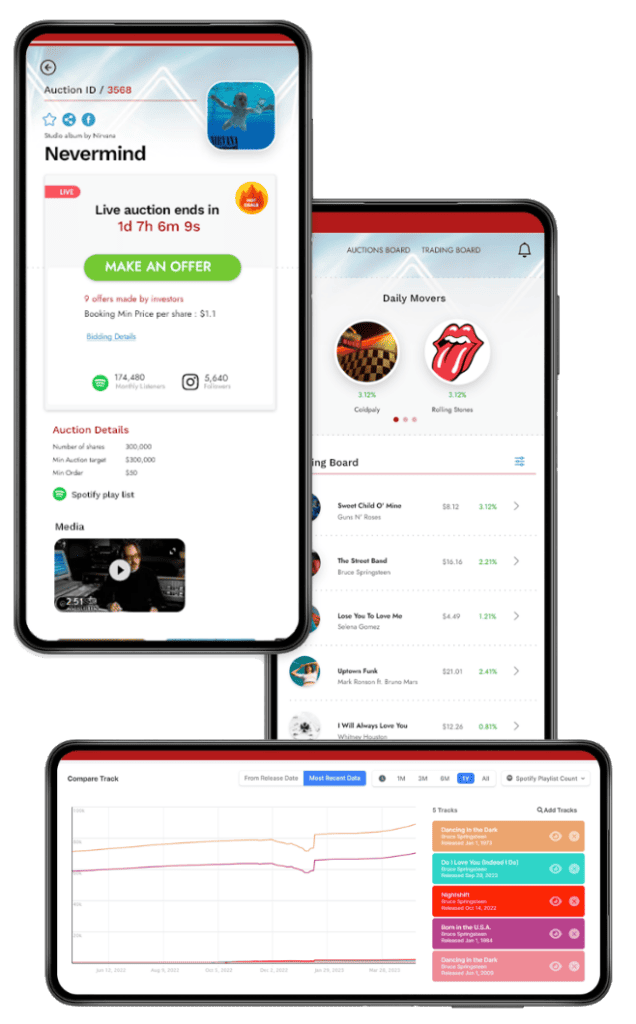

Finally, investing in music royalties also allows for the monetization of the investment through the secondary market. The secondary market is where investors can sell their music royalties to other investors at a profit if the value of the royalties increases. By doing so, investors can realize their gains and reinvest in other music royalties, creating a portfolio of diversified assets. In conclusion, investing in music royalties presents a new and vibrant investment opportunity for both fans and investors.

By investing in music royalties, individuals can gain exposure to the true value of art, reflecting all elements of price construction, such as future cash flows, artistic and emotional value, artist career trajectory, fans’ affection, and social media awareness. Investing in music royalties can provide a steady stream of passive income while offering the potential for capital gains and providing investors with a way to contribute to the growth and development of the music industry.

Stay tuned!

Fans seize the power of trade